General ledger analysis report consists of details such as Opening balance, debits, credits, net change and closing balance of Main account. This report can be used by account managers to check and update the accounts correctly. The key elements of this reports are:

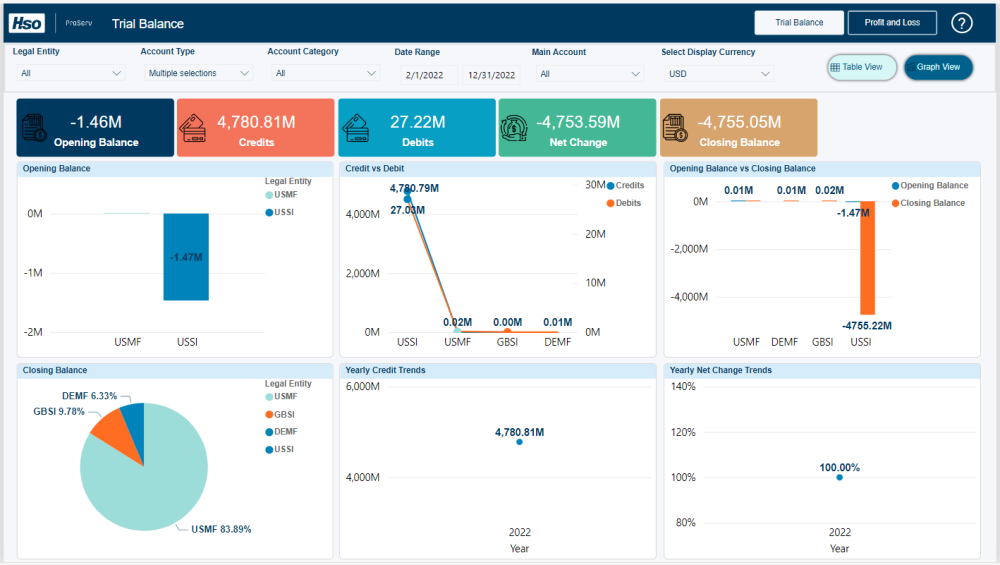

Trail Balance: It gives an insight about the Opening Balance, Closing Balance, Debit, Credit which will help us in monitoring the account health.

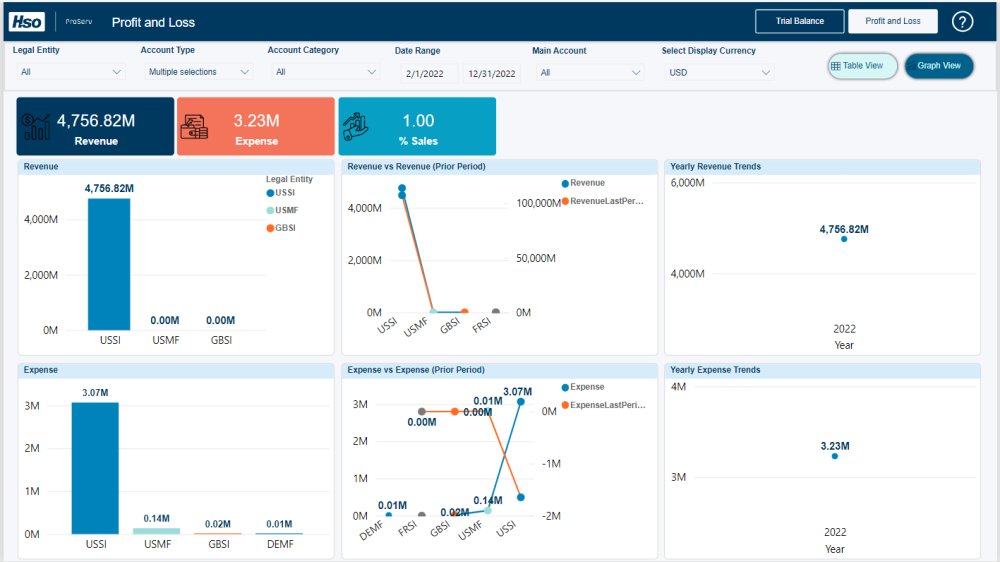

Profit & Loss: It gives an insight about the expense, revenue which will help us in understanding about the account’s performance.

On the first tab Trail Balance, the graph view at the left side shows Opening Balance & Closing Balance of the selected Main Account for the selected date range. At the Right side we are showing Credit Vs Debit, Opening Balance Vs Closing Balance and Yearly Credit Trends.

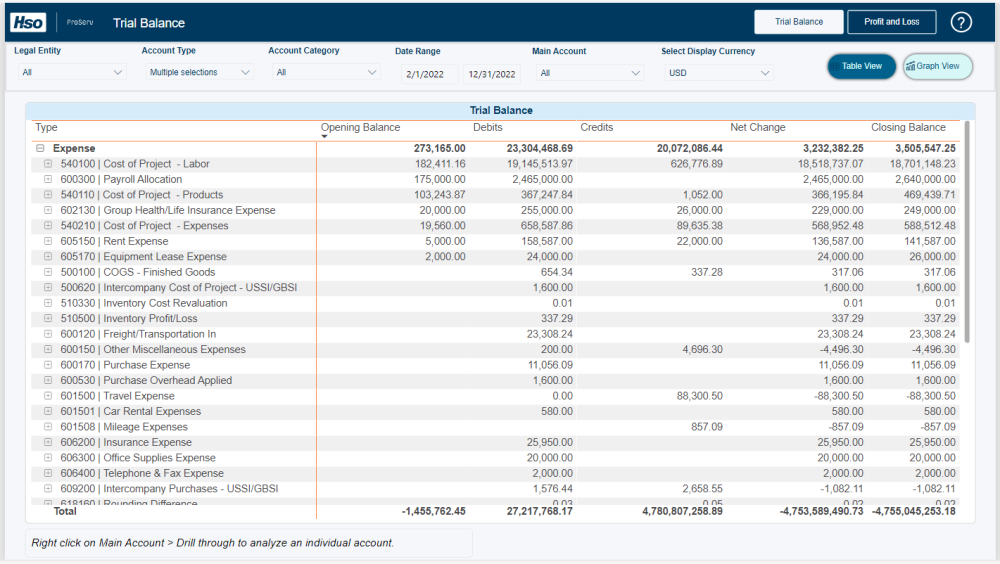

The table view of Trial Balance is a summary drill down by main account type and main account id on Opening Balance, Debits, Credits, Net Change, Closing Balance.

Here user can drill through for account to see the further details by Revenue, Expense and Balance sheet for the selected account.

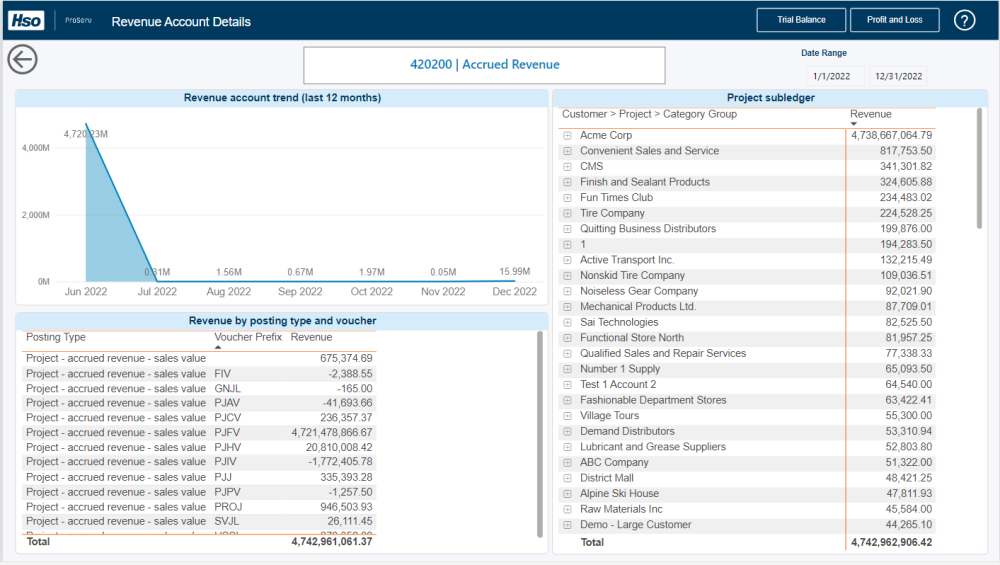

In drill down user can see the Revenue by posting type and a trend on revenue for last 12 months.

On the second tab Profit and Loss, in the Graph View at the left side we are displaying a trend of Revenue, Expense based on Legal Entity. At the middle section we are displaying a trend of comparison between Revenue earned in current period and revenue earned in the prior period, a trend of comparison between current period’s expense and prior period’s expense for every legal entity. AT the right side of the report, we are displaying the yearly revenue and expense trends.

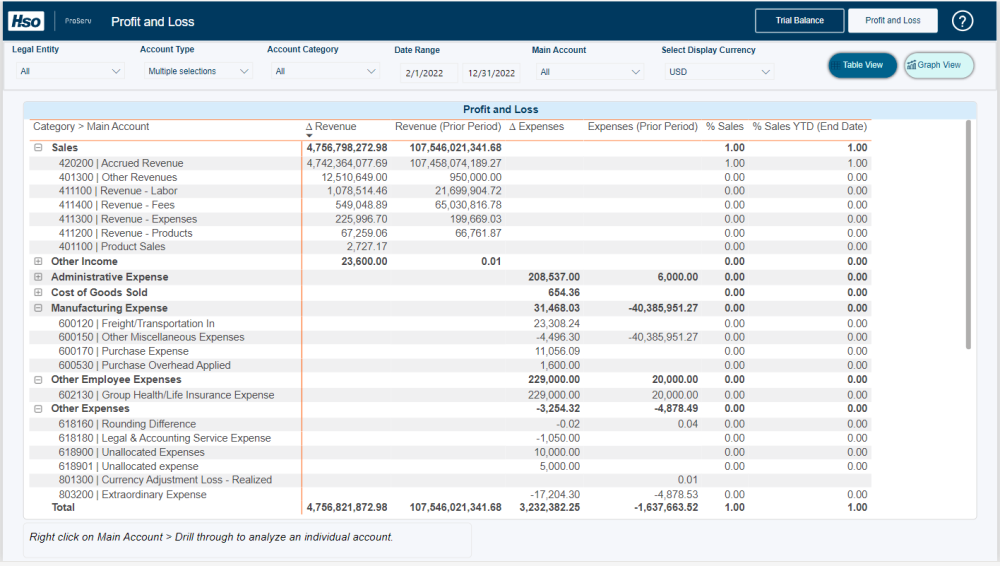

In the table view, is a summary drill down by Category and main account on Revenue, Revenue (Prior Month), Expenses, Expenses (Prior Month), % Sales, % Sales YTD (End Date).

Revenue drill through.

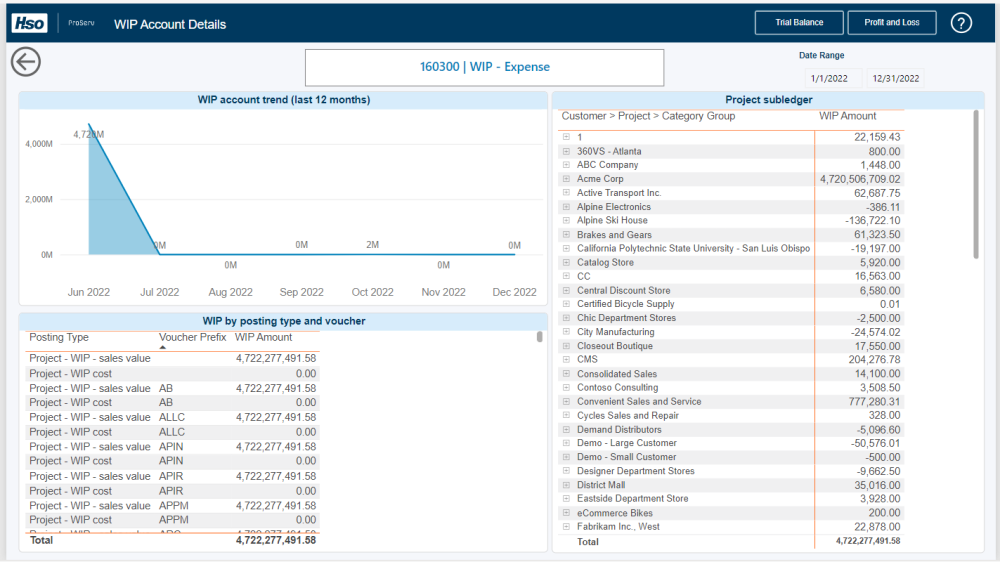

WIP drill through.

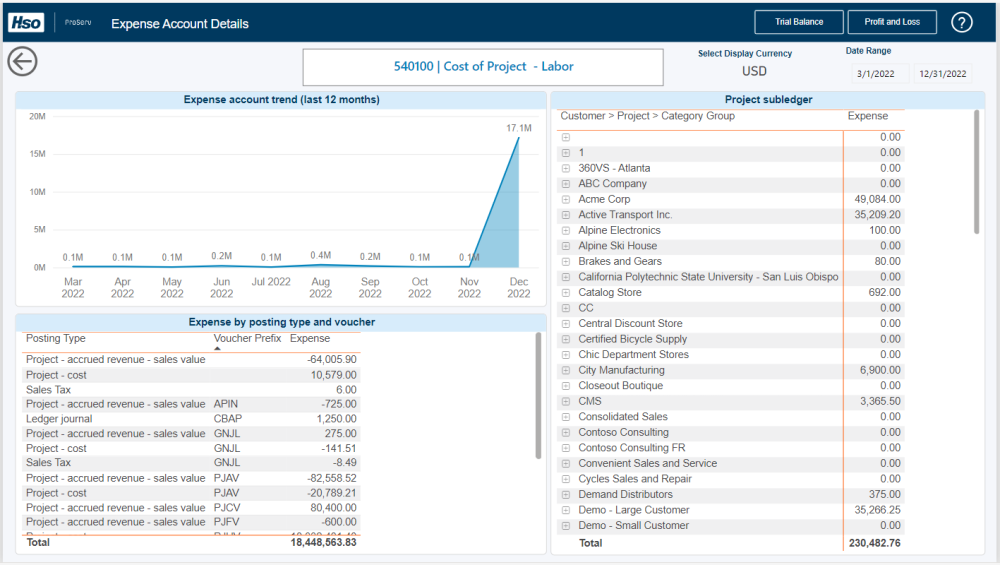

Expense drill through.

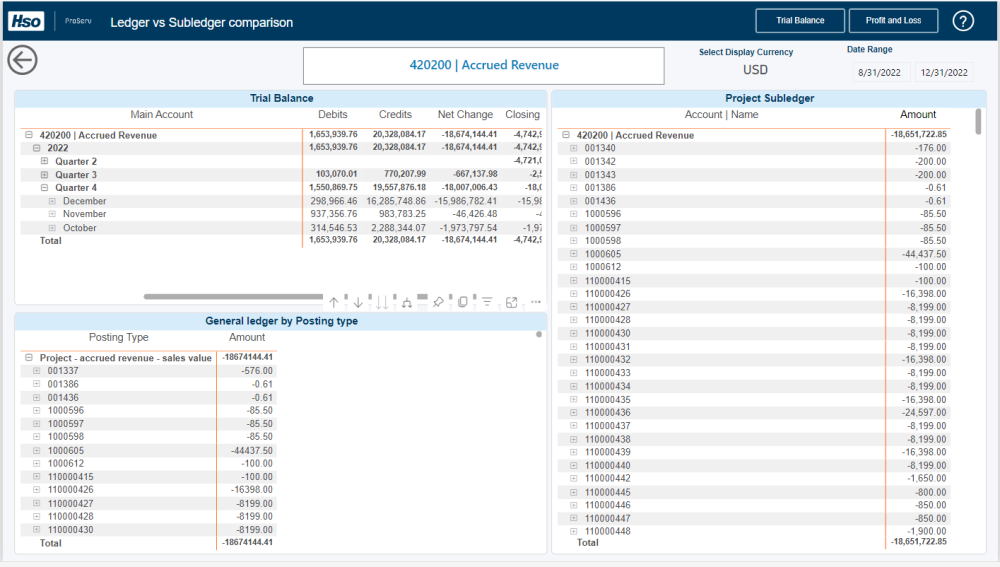

Ledger vs Subledger comparison drill through.

Post your comment on this topic.