. This report will provide insights and information related to company outstanding customer invoices and payments owed by the customers.

. This report will help the organization in the AR process and track the collections impacting the organization’s cash flow. The key elements of this report are:

. Receivable: The Receivable amount that has to be received by the customers; this will help to track the invoices and incoming payments.

. Aging Analysis: Aging Analysis categorizes outstanding customer balances based on their due dates. This tab will help in identifying overdue invoices and tracking the time since the invoice was generated.

. Payments: This tab will allow users to analyze the payment patterns, providing them with information on customers who consistently pay on time and those who have a history of late payments.

. DSO: Over time, Days Sales Outstanding will allow you to track your company’s credit and collection processes. A lower DSO indicates that the company is collecting payments from customers more quickly, resulting in better cash flow. On the other hand, a higher DSO indicates that customers are taking longer to pay, which may impact cash flow in the future.

. Collection Management: This tab will enable users to monitor and manage collection efforts. They will be able to review and identify customers with outstanding balances and take appropriate action.

This report will provide crucial information for maintaining healthy customer relationships, optimizing cash flow, identifying areas for improvement, and assessing efficiency.

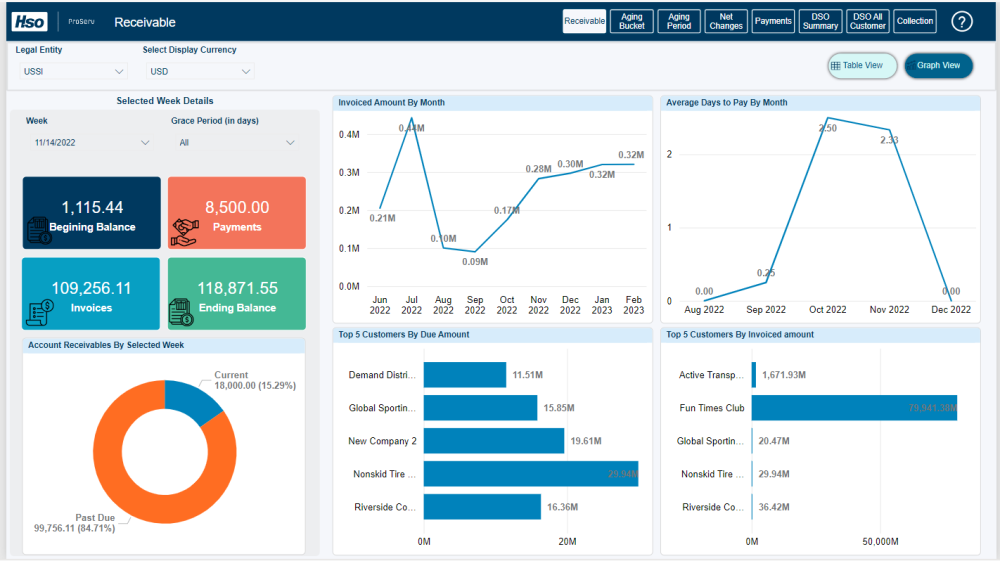

On the left side of the first ‘Receivable(s)’ tab, it shows the information of balances (beginning and ending), payments, and invoices for any selected week. On the right, it shows the trend in invoice amount by month and it also consists of the top 10 payments and top 10 dues by customers.

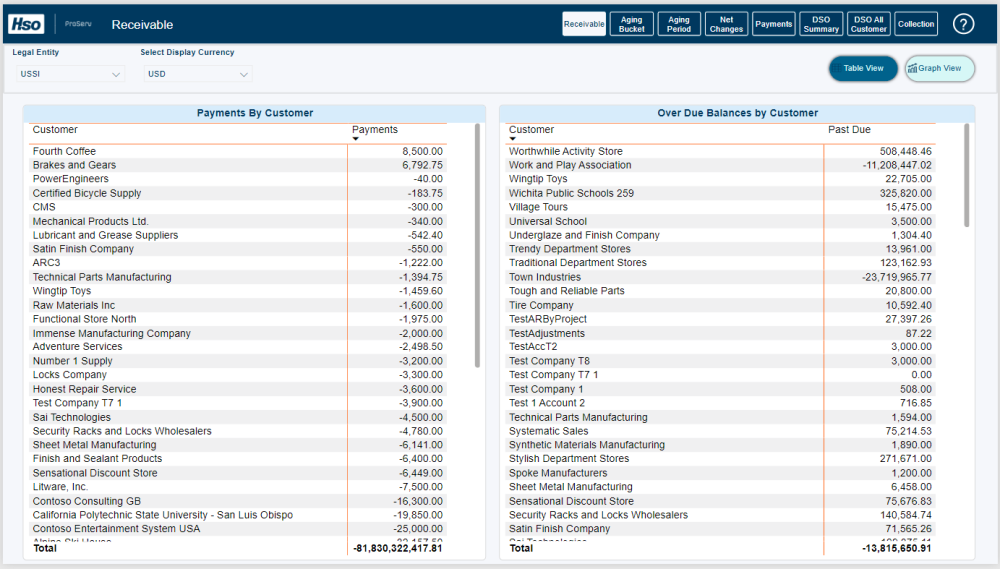

The table view of receivable tab has detailed information on dues and payments by customers.

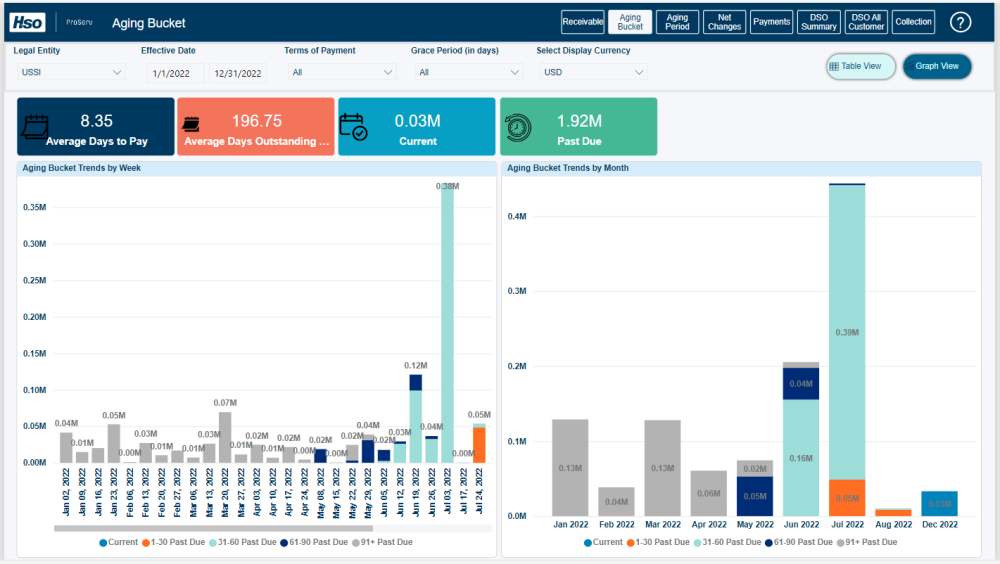

The Aging Bucket tab consists of past-due information by week and by month.

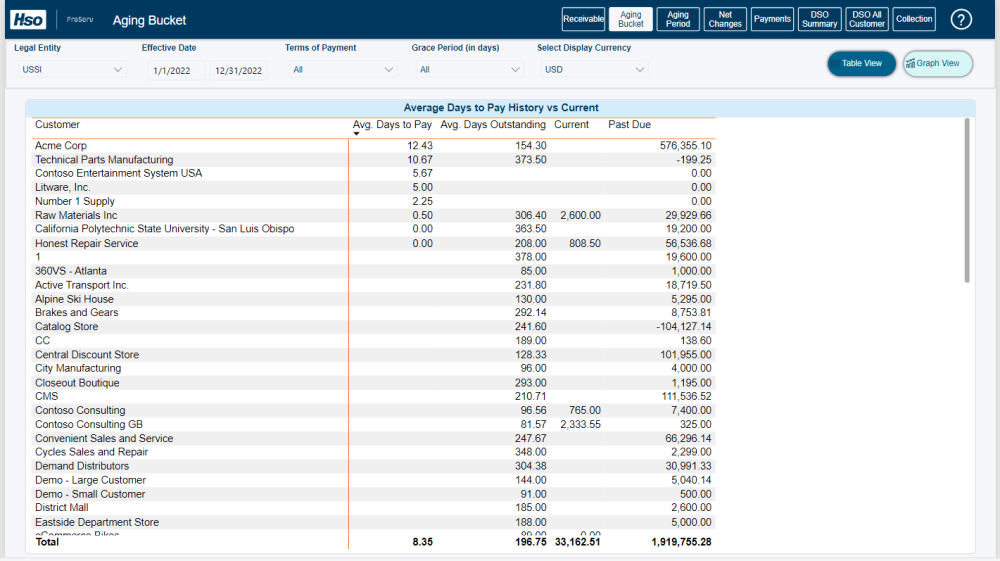

The Table view of the Aging Bucket tab has detailed information on payment history and the current period by customer.

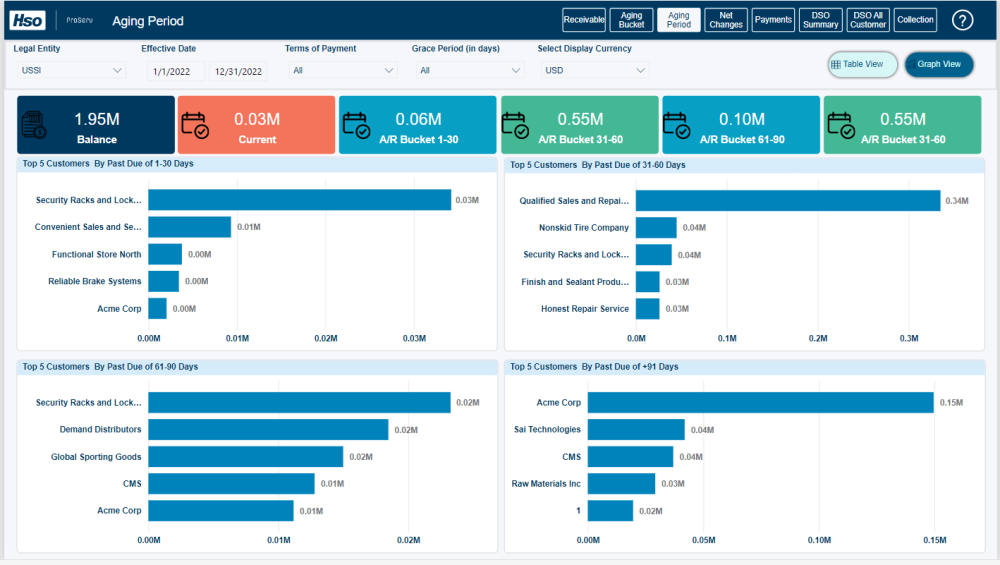

The Aging Period tab consists of the top 5 customers aging by project. Different types of aging buckets are as follows.

current,

1–30,

.31–60,

61–90 days,

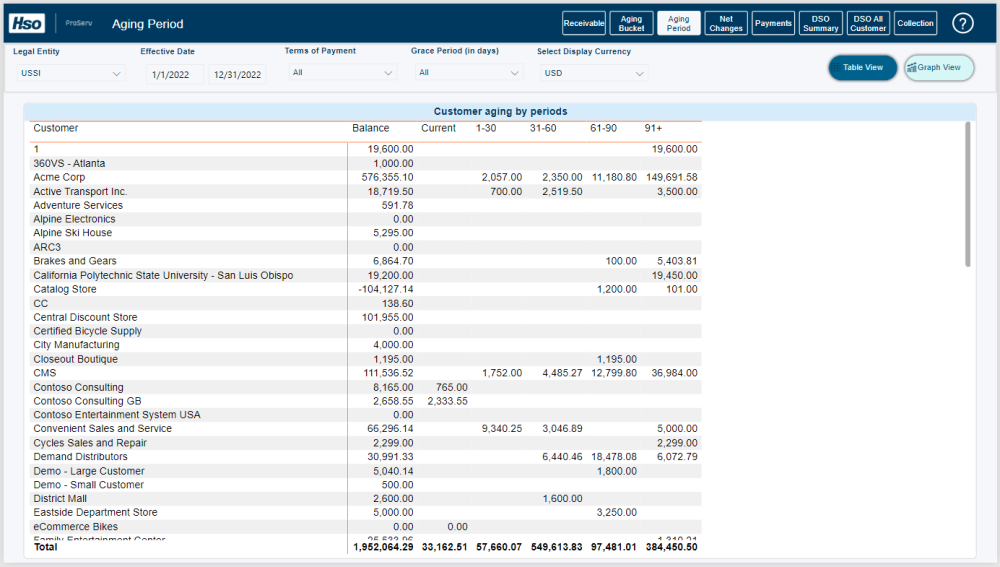

The Table View of Aging Period tab has detailed line-wise information on balance and aging by customer in different buckets.

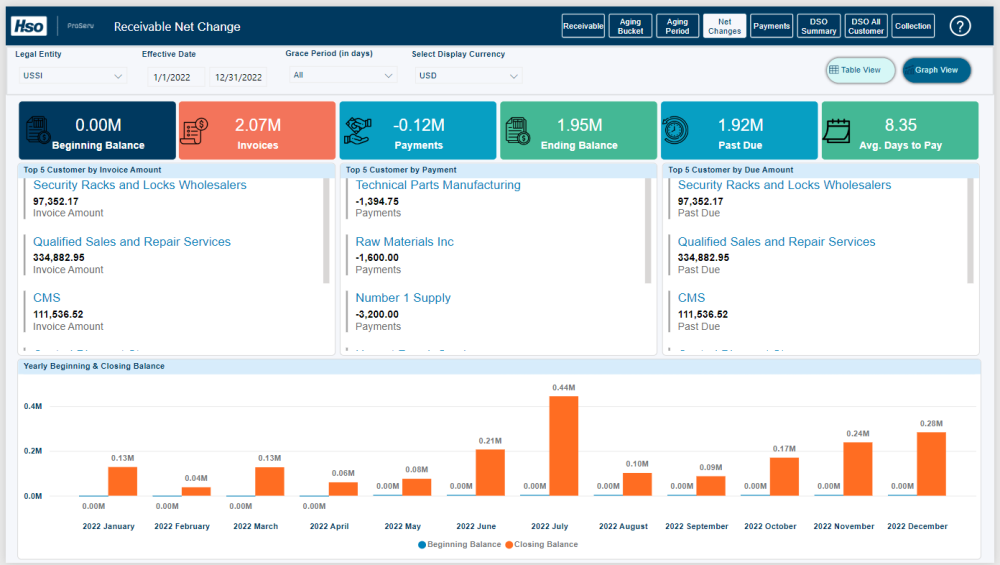

Receivable Net Change tab contains top 5 customers on invoices, payments, past due, and a trend on balances (opening and closing).

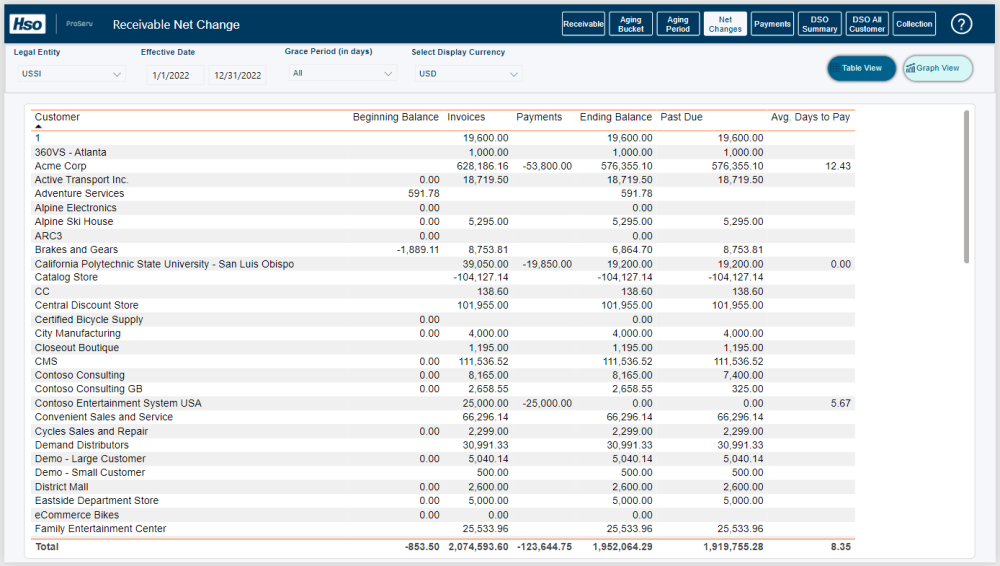

The table view of Receivable Net Change tab has detailed line-wise information on the beginning balance, invoice, payment end balance, and average days to pay by customer in different buckets.

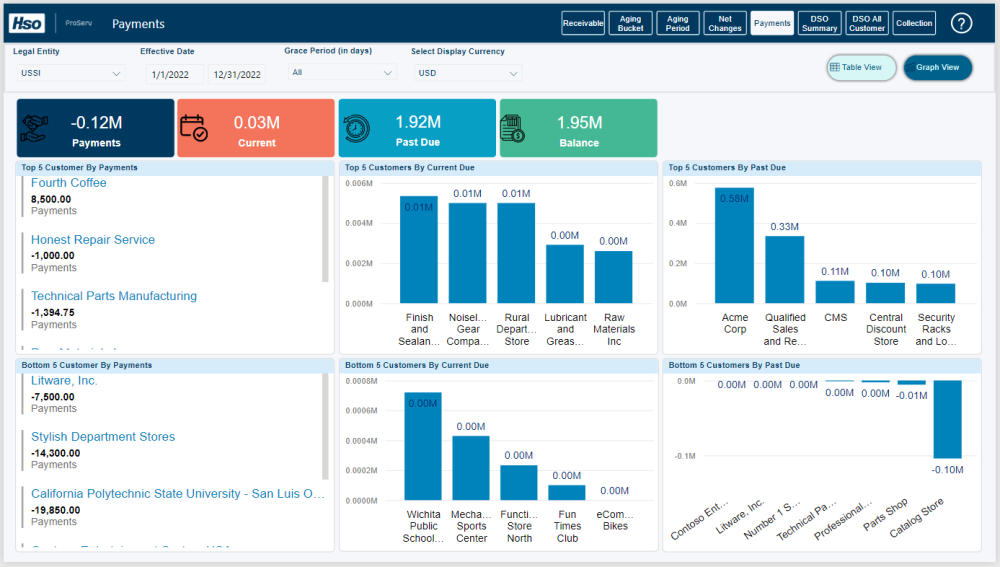

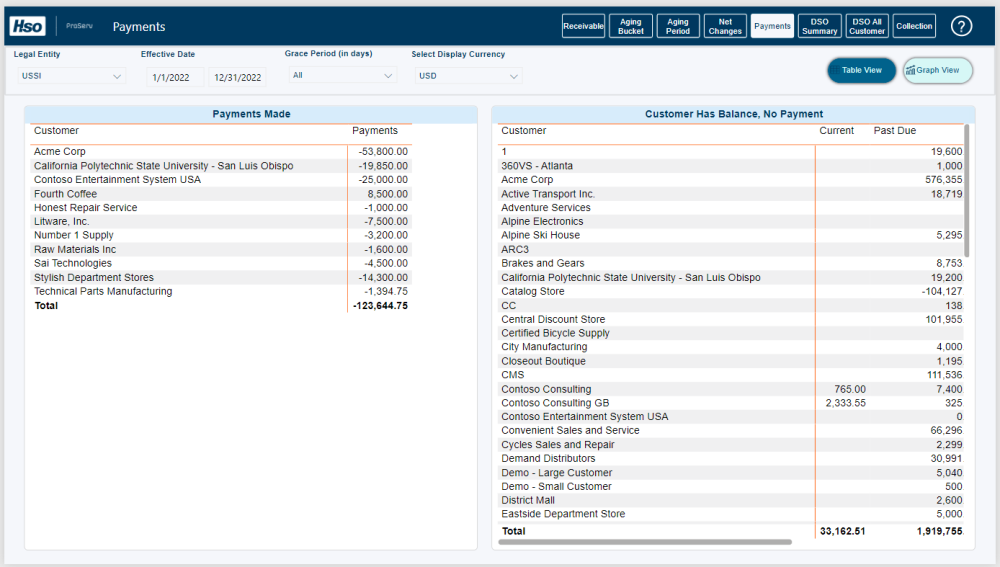

The Payments tab consists of the top 5 and bottom 5 customers by payment dues (current and past).

The Table View of Payments tab has detailed information on payments and balances by customer.

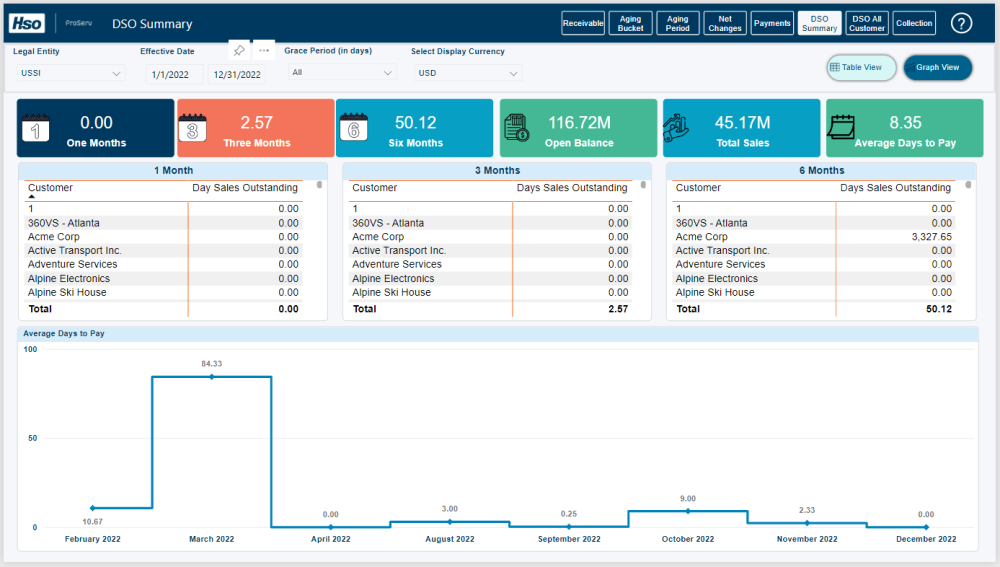

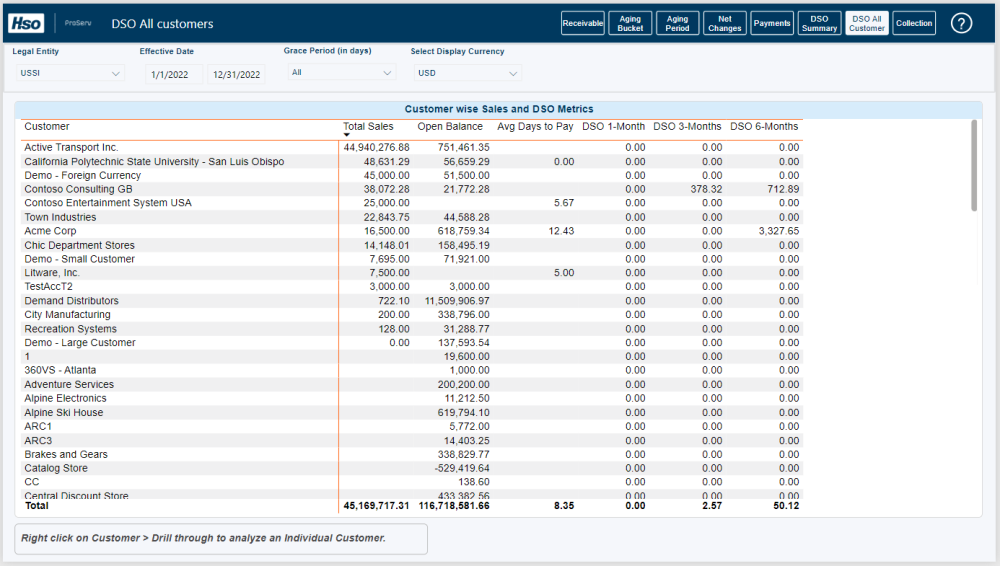

DSO summaries consists of ratios calculated for one, three, and six months by the customer. We have key KPIs of open balance, total sales, and average days of payment pending.

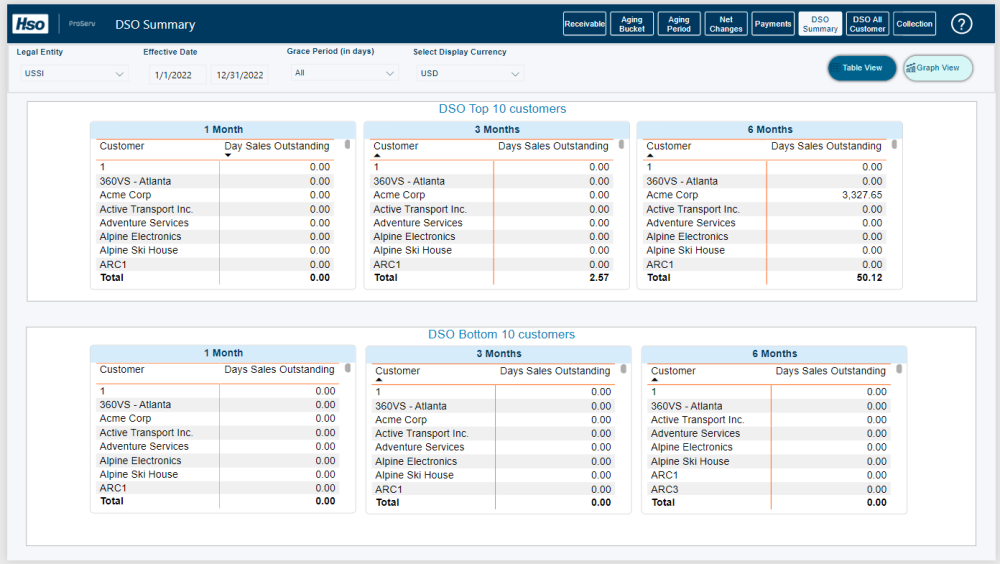

Table view of DSO summary consists of top and bottom 10 customer summary by month (1, 3, 6 months).

DSO All Customers tab consists of customer-wise Sales and DSO Metrics.

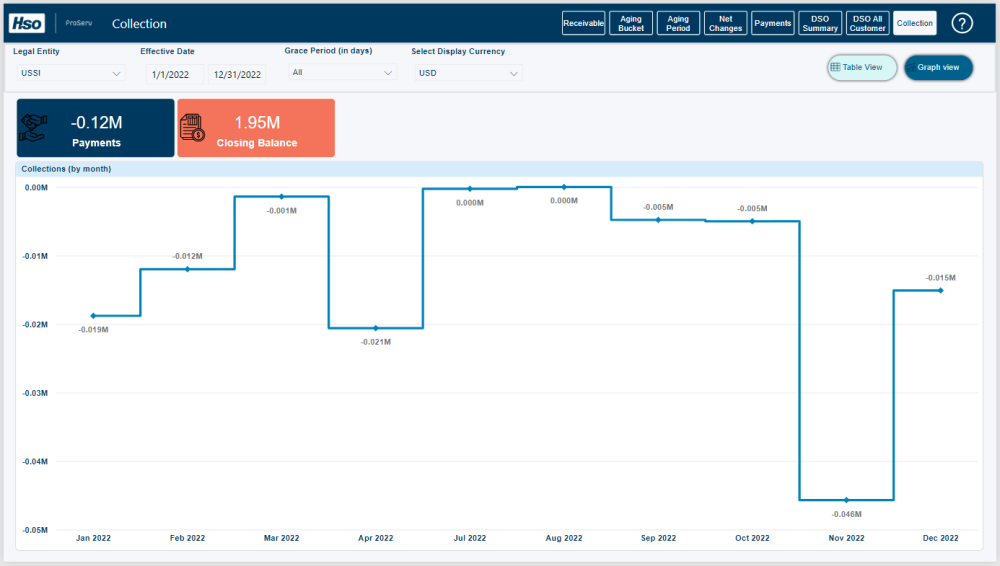

The Collection tab shows collections made per month.

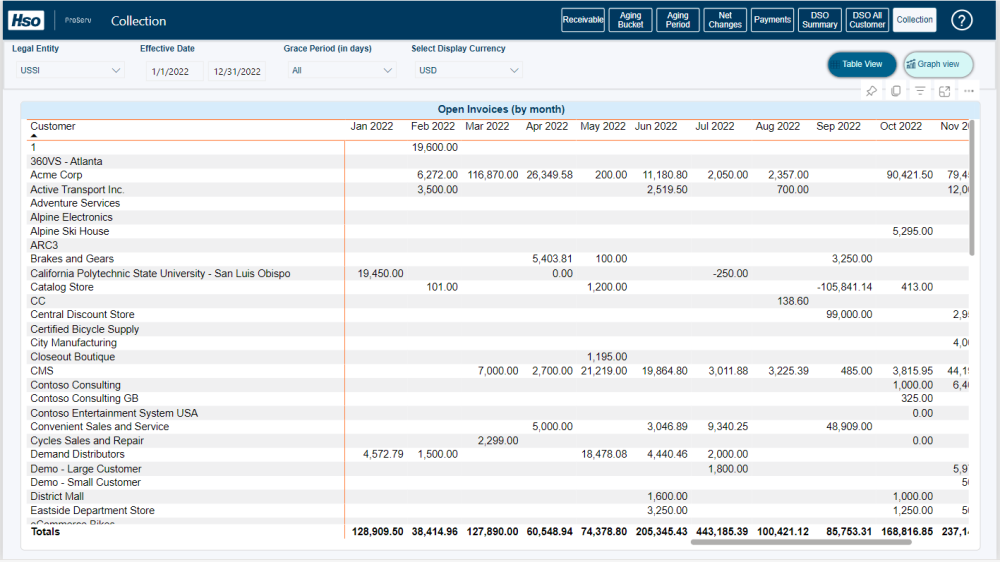

The table view of the collection tab has detailed information on open invoices by month.

Post your comment on this topic.